For SSS Pension Plan: Should I pay the Maximum or the Minimum SSS Contribution?

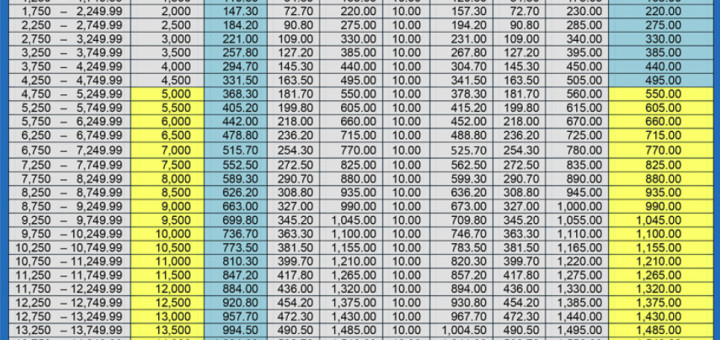

My brother is an OFW in Saudi Arabia and he pays his maximum SSS contribution quarterly. I was surprised when he sent me a private message on Facebook and asked me if he should...