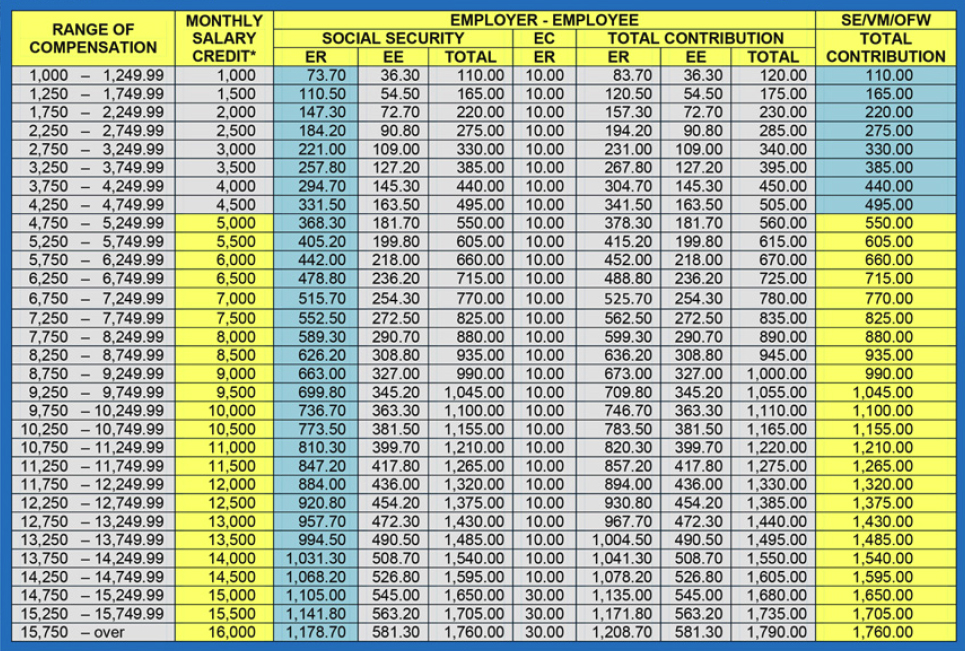

For SSS Pension Plan: Should I pay the Maximum or the Minimum SSS Contribution?

My brother is an OFW in Saudi Arabia and he pays his maximum SSS contribution quarterly. I was surprised when he sent me a private message on Facebook and asked me if he should continue paying the maximum SSS contribution. When I asked why, he gave me the link to this video from ANC On […]

For SSS Pension Plan: Should I pay the Maximum or the Minimum SSS Contribution? Read More »