My 12 Key Takeaways from the Cashflow 101 Event

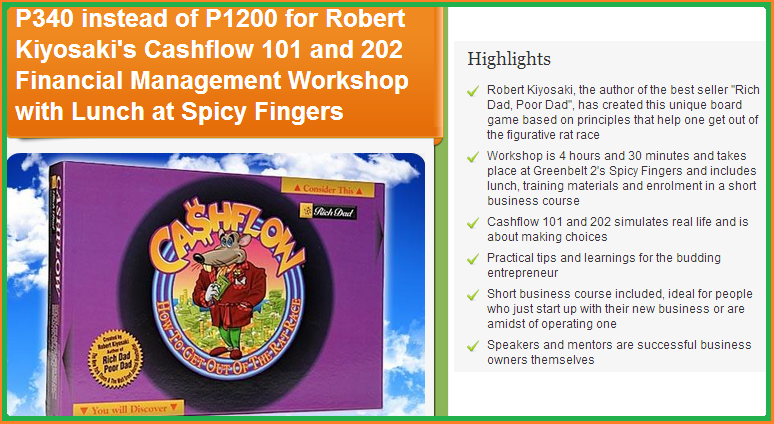

Two weeks ago, I attended the Cashflow 101 board game / workshop at the Crown Plaza Hotel in Ortigas, Pasig City. This was my second time to play this board game. The first time was early in 2012 and that was also the first time I heard about the stock market, which I shared on […]

My 12 Key Takeaways from the Cashflow 101 Event Read More »